On this page

Trending

President Trump announces tariff plans amid market turbulence

White House establishes 10% baseline tariff for all exporters to the U.S. and details roughly 60 specific countries that will have tariffs greater than 10%.

The economy

Track the economic trends likely to impact your finances.

Capital markets

Stay a step ahead with market updates and analyses that can inform your investing strategy.

Sector spotlight

Explore stock market performance across key S&P 500 sectors.

Global markets and geopolitics

Stay attuned to evolving dynamics changing our world, and the risks and opportunities they present.

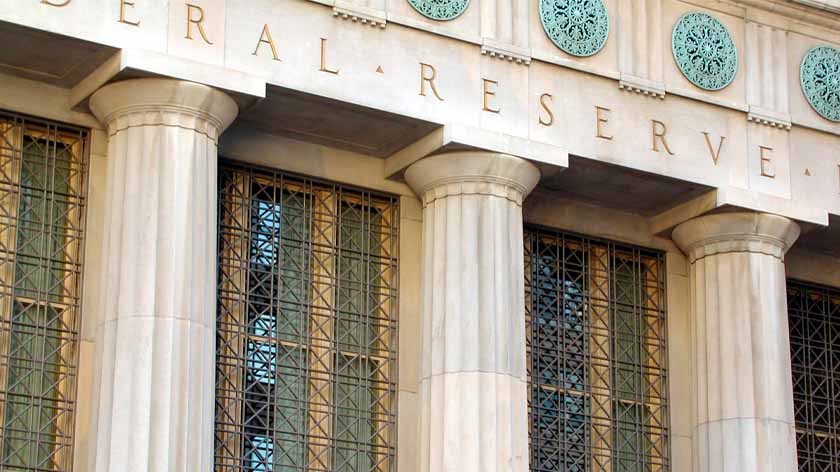

Monetary policy, taxes and legislation

Gain insights about the events, debates and policy decisions shaping today’s financial landscape.

Insights and analysis

Start of disclosure content