Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

So far this year, energy stocks lead all S&P 500 sectors.

Although the S&P 500 is in negative territory as of early April 2025, the energy sector is up more than 10%.

Rising natural gas prices are the biggest contributor to the sector’s strong start.

While the S&P 500 is down 4.27% overall so far this year, energy is up10.21%, outpacing all other sectors. This contrasts with energy’s decline of 6% on the year in 2024, which significantly lagged the broader market’s 25% total return.1

The energy sector’s longer-term returns remain impressive. It’s generated an 11.08% annualized return over three years and a 31.58% annualized return over the last five years ending March 31, 2025.1

“Rising natural gas prices are the biggest driver of energy sector performance,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management Group. “Natural gas companies comprise about 30% of the sector’s S&P 500 index.” In early 2025, natural gas prices are significantly higher than that they were at the at the start of the year.2 “Demand for liquid natural gas (LNG), particularly from European markets, plays a role in price increases,” says Haworth. European nations are replacing supplies that, before Russia invaded Ukraine, were sourced from Russia.

The U.S. is the world’s largest LNG exporter. 53% of U.S. LNG exports go to Europe, with 26% bound for Asia.3 “Recently, the U.S. eased up on restrictions that affected LNG flows to other countries, boosting export activity,” says Haworth. What’s more, 2024 U.S. natural gas consumption reached record monthly levels.2

Energy prices peaked in 2022 as demand surged with the end of COVID-related shutdowns and the onset of the Russia-Ukraine war. Prices declined significantly since. In 2023, oil prices were flat to lower, and energy stocks followed suit. Oil prices moved above $80/barrel by mid-March 2024, then held between $70 and $80/barrel for much of 2024’s summer months but have hovered in the $70/barrel range since September.2 In 2025’s first quarter, natural gas prices rose nearly 25% while prices were relatively flat for all other key energy products.2

|

Category |

2022 Peak Price |

2024 End Price |

Recent Price |

% Change from Peak |

% Change Year-to-Date |

|---|---|---|---|---|---|

|

Crude Oil (barrel) |

$123.64 |

$72.44 |

$69.46 |

-43.8% |

-4.2% |

|

Gasoline (gallon) |

$5.01 |

$3.00 |

$3.16 |

-36.9% |

4.9% |

|

Natural Gas (mil. Btu) |

$9.48 |

$3.40 |

$4.03 |

-59.1% |

24.9% |

|

Heating Oil (gallon) |

$5.15 |

$2.14 |

$2.16 |

-58.5% |

1.0% |

Category

Crude Oil (barrel)

2022 Peak Price

$123.64

2024 End Price

$72.44

Recent Price

$69.46

% Change from Peak

-43.8%

% Change Year-to-Date

-4.2%

Category

Gasoline (gallon)

2022 Peak Price

$5.01

2024 End Price

$3.00

Recent Price

$3.16

% Change from Peak

-36.9%

% Change Year-to-Date

4.9%

Category

Natural Gas (mil. Btu)

2022 Peak Price

$9.48

2024 End Price

$3.40

Recent Price

$4.03

% Change from Peak

-59.1%

% Change Year-to-Date

24.9%

Category

Heating Oil (gallon)

2022 Peak Price

$5.15

2024 End Price

$2.14

Recent Price

$2.16

% Change from Peak

-58.5%

% Change Year-to-Date

1.0%

All prices published by U.S. Energy Information Administration. Crude Oil price per barrel: West Texas Intermediate (WTI) – Cushing, Oklahoma as of March 24, 2025. Gasoline price per gallon: U.S. Regular All Formulations as of March 31, 2025. Natural Gas price per million BTU: Henry Hub Natural Gas Spot Price as of March 24, 2025. Heating Oil price per gallon: No. 2 Heating Oil Prices: New York Harbor as of March 24, 2025.

“The oil market lacks a clear pricing trend at this point. We don’t have accelerating global economic growth to drive demand higher, and there’s not a global recession cutting into demand.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

The U.S. is now the world’s largest oil producer, though production levels are down so far in 2025.4 Supply interruptions occurred worldwide as OPEC+ trimmed production levels to boost oil prices. Increased U.S. oil production helped overcome supply shortfalls. The U.S. is now a net oil exporter.5

Nevertheless, oil consumption worldwide is still on the rise with continued growth projected through 2026.6

Oil prices in 2025 are little changed. “The oil market lacks a clear pricing trend at this point,” says Haworth. “We don’t have accelerating global economic growth to drive demand higher, and there’s not a global recession cutting into demand.” Haworth also anticipates rising global supplies as OPEC+ brings more production online. At the same time, President Donald Trump is halting recent efforts to refill the U.S. Strategic Petroleum Reserve, a process begun under President Joe Biden’s administration. Trump’s decision reduces overall demand.

In the 1970’s, the energy sector represented approximately 15% of the broader U.S. stock market . Today, it makes up just 3.7% of the S&P 500 index.1 “Yet energy consumption is up since the 1970s, and the important role energy plays in the broader economy is not diminished,” says Haworth. “From an earnings (profit) perspective, energy stocks play a more prominent role in today's S&P 500 than their index weighting would indicate.”

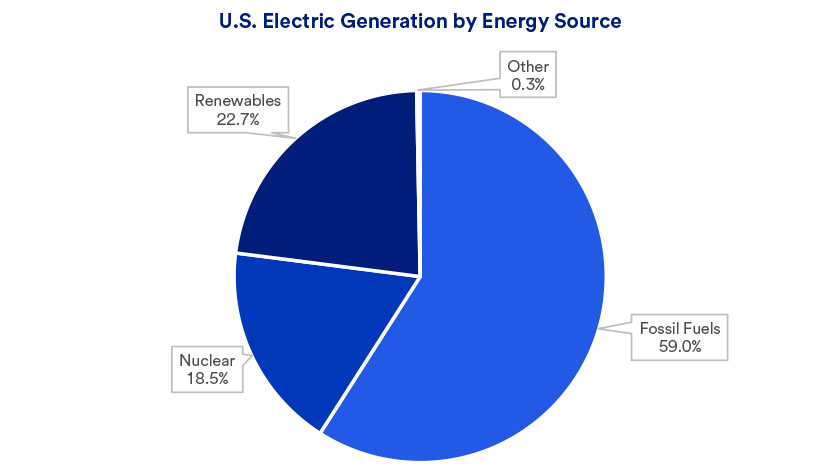

Renewable energy sources such as wind and solar are part of the energy picture today as efforts are made to reduce fossil fuels’ carbon footprint. Still, renewables make up less than 25% of U.S. electricity generation.7

“Alternatives like wind and solar are not a factor in the S&P 500 Energy Index to this point,” says Haworth. “In some cases, they may be represented in other sectors of the market, such as utilities or information technology.”

Investments in the energy sector today are primarily directed toward more traditional companies that participate in industries like oil and natural gas. “The demand for fossil fuels is not going away in the near term,” says Haworth. He emphasizes that opportunities are available even in a market featuring more stable prices. “Many exploration and production companies have productive oil wells and should be able to generate solid profit margins,” says Haworth. “Since these companies tend to return capital to shareholders in the form of dividend payouts, their stocks represent an opportunity for income-orientated investors.” Based on March 31, 2025 data, the S&P 500 energy sector generates a 3.34% dividend yield, compared to 1.30% for the broader S&P 500.1

Other opportunities can be found among so-called midstream energy companies that transport crude oil or refined petroleum products. “This sector is less dependent on energy prices than on the flow of oil, and volume moving through these facilities remains high,” says Haworth. Midstream companies tend to pay attractive dividends. However, the investment process can be more complex as it sometimes requires investments in limited partnerships. Partnerships issue K-1 forms to investors for tax reporting purposes, which can complicate an investor's tax filing process.

Consider consulting with your financial professional to determine whether targeted investments in the energy sector can help you meet your long-term financial goals.