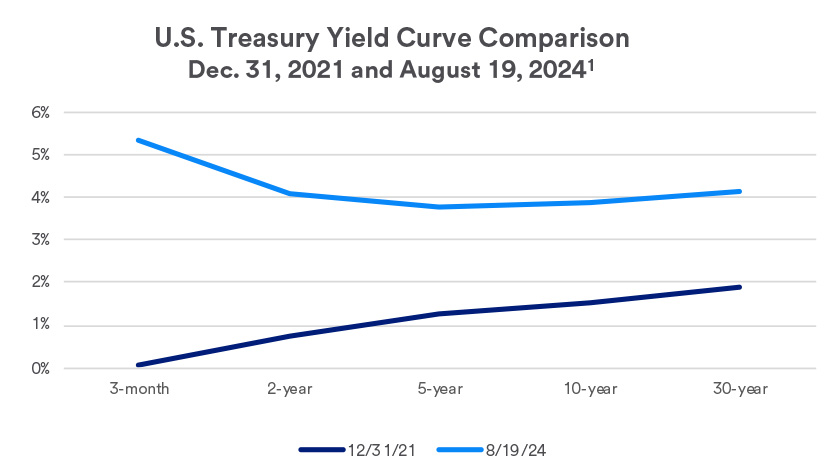

“Ultimately, declining yields on the long end of the bond market reflect long-term inflation and economic growth expectations,” says Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management. “The short end of the yield curve has mostly held steady, more directly anchored to the Fed’s stance on the fed funds rate.”

While the Fed seeks to maintain low inflation and maximum employment, in the last 2+ years, the Fed has primarily focused on its inflation mandate. Encouraging signs to investors were recent comments by Fed chair Jerome Powell.

“When we were far away from our inflation mandate, we had to focus on that. Now we’re back to a closer to even focus, so we’re looking at labor market conditions and asking whether we’re getting what we’re seeing,” said Powell.3 A primary inflation measure, the Consumer Price Index (CPI) stood at 2.9% for the 12-months ending in July, its lowest reading since March 21.

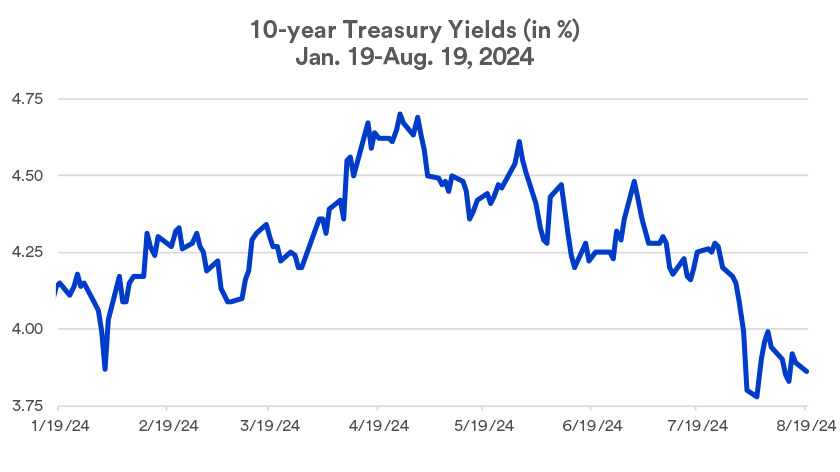

In the meantime, July’s unemployment rate ticked up to 4.3%, its highest level since October 2021.4 In early August, investors reflected concern that labor market weakness was a potential risk to future economic growth. Stock prices temporarily declined, though regained lost ground since. Bond yields declined at that point as well but have generally remained lower since.

What should investors expect from the bond market and Fed interest rate policy for the remainder of the year and what does that say about how to incorporate or adjust strategies for fixed-income investors?

Have bond yields peaked?

The Fed is trying to find a sweet spot, driving inflation lower without slowing the economy to the point that it causes a recession. So far, the Fed has achieved this so-called “soft landing” for the economy, but the Fed continues to walk an economic tightrope. “The overriding pressures on Treasury yields are the Fed, Treasury supply and then growth and inflation,” says Tom Hainlin, senior investment strategist, U.S. Bank Wealth Management.

To this point, the economy continues on a positive track. Second quarter 2024 economic growth as measured by Gross Domestic Product (GDP), was 2.8% (annualized rate), double its first quarter level. That’s lower than 2023’s final two quarters, which registered annualized GDP gains of 4.9% (third quarter) and 3.4% (4th quarter).5

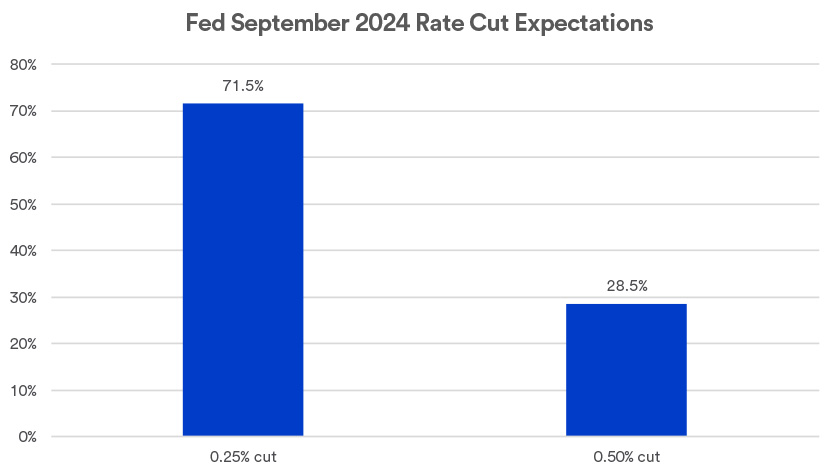

Given the back-and-forth of economic data, investors can expect that yields will fluctuate in a modest range, at least in the near term, as markets assess economic prospects. Current market expectations are that the Fed will almost certainly initiate rate cuts at the September 2024 Federal Open Market Committee (FOMC) meeting. The bigger question is whether the rate cut will be 0.50% or a more modest 0.25%. Current market expectations are leaning toward a more modest cut, though Fed officials may provide additional guidance before it sets interest rate policy at the mid-September FOMC meeting.6