Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to refocus your investment strategy.

Key takeaways

Investors today hold close to $7 trillion in money market funds.

Many are attracted by today’s higher interest rates available on low-risk, shorter-term securities.

The interest rate environment continues to evolve as the Federal Reserve considers further cuts.

American investors hold a record $6.9 trillion in money market fund assets.1 The amount currently invested in these short-term accounts continued growing in late 2024, even as the Federal Reserve (Fed) made initial interest rate cuts that began to be reflected in lower money market yields.

Nevertheless, short-term yields today remain competitive compared to the environment that existed prior to 2022. The Fed is providing additional reassurance for cash investors by signaling that it may only marginally cut short-term rates over the course of 2025.2 Nevertheless, says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management, “Investors should consider how to most effectively position assets to meet both short- and long-term goals.” Haworth points out that it can be useful to distinguish cash that can be actively invested to meet key asset accumulation goals from cash required to meet current or emergency expenses.

“Those who continue to put money to work in cash-equivalent vehicles as an alternative to stocks have, since late 2022, missed out on what proved to be an impressive period for stock market returns."

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

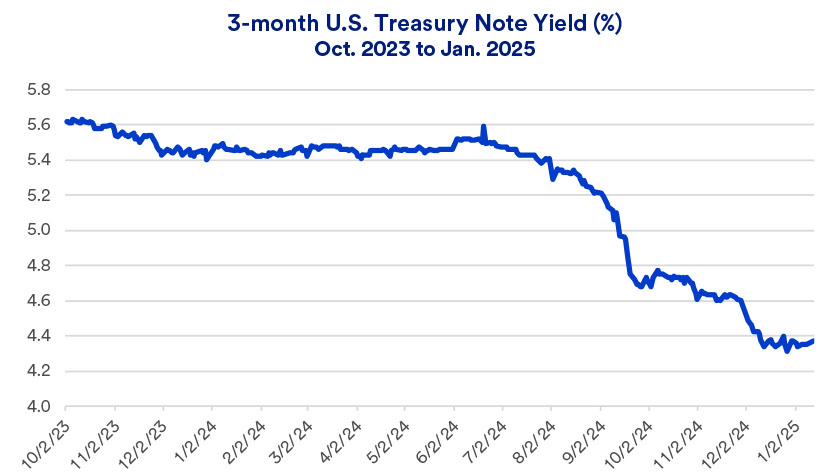

Yields on the 3-month U.S. Treasury note, a benchmark for short-term securities, have dropped significantly from highs reached 15 months prior, in October 2023.3

In mid-2024, a short-term yields declined as investors anticipated pending Fed interest rate cuts. From early 2022 to mid-2023, the Fed raised the short-term federal funds target rate, applied to overnight loans banks make to one another, more than 5%. It held rates at that level for more than a year until reversing course and reducing the fed funds target rate by 1% between September and December 2024. “Rates controlled by the Fed are closely linked to market rates for shorter-term securities,” says Haworth.

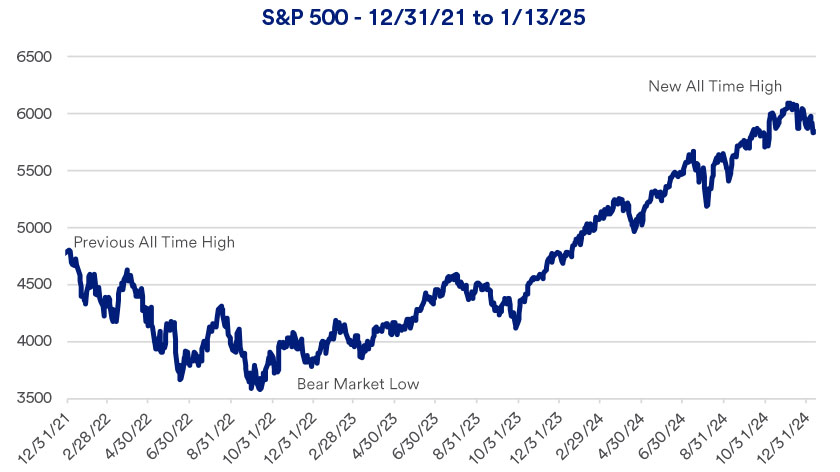

Haworth, points out that even when rates were at their highest levels, “Those who continue to put money to work in cash-equivalent vehicles as an alternative to stocks have, since late 2022, missed out on what proved to be an impressive period for stock market returns.” In 2023 and 2024 combined, the benchmark S&P 500 stock index’s total return exceeded 57%.4

For much of that same period, the bond market has been a mixed bag. Most notably in the wake of the Fed’s late 2024 interest rate cuts, yields on 10-year U.S. Treasuries, a benchmark for everything from longer-term bond yields to mortgage rates, trended higher. The 10-year U.S. Treasury yield jumped from 3.63% in mid-September 2024 to 4.79% in mid-January 2025.3 When yields rise, bond prices decline.

Haworth says it can be helpful for investors to consider how assets are allocated to meet both short-term and long-term goals.

You may want to maintain up to 18 months’ worth of assets in accounts that offer some degree of immediate liquidity. These resources can be used to meet living and lifestyle expenses, tax liabilities, repay debts and serve as an emergency fund. For these purposes, consider higher yielding checking accounts, money market mutual funds or CDs.

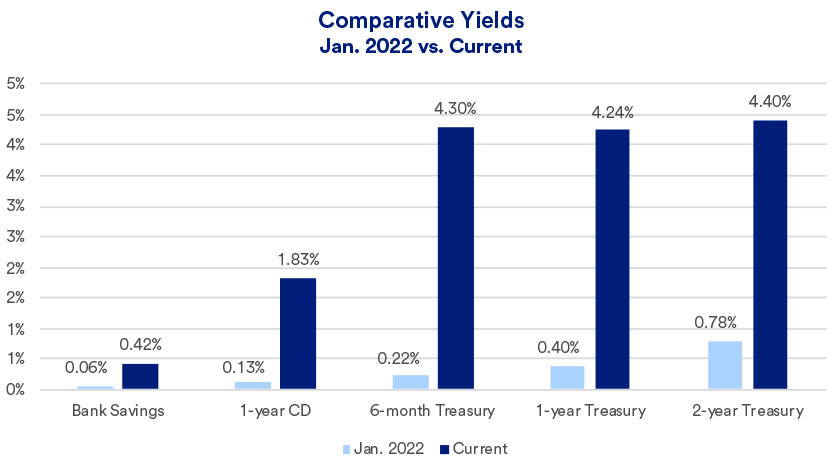

For money that may be required after 18 months, consider money market funds, Treasury bills and short-term bonds that may offer the potential to generate additional yield while still protecting principal. Today’s yield environment is considerably different from what existed three years prior.5

Fed rate cuts have their greatest impact on shorter-term securities and in recent months, that trend played out, though the Fed may temper rate cuts going forward. “There are many factors that will affect Fed interest rate decisions,” says Haworth, “including inflation trends and whether the economy can continue growing at a solid pace.”

Resources not needed for near-term purposes can be invested with the objective of generating more attractive, longer-term returns. “Cash yields may be attractive, but ultimately not as attractive than owning a diversified, long-term portfolio,” says Haworth. “Stocks and bonds historically generate returns that outpace inflation over time.”

Haworth says for investors with long-term goals, consider seeking out returns from more complex fixed income investments. These can include non-government agency issued residential mortgage-backed securities and structured credit for non-taxable portfolios. For tax-aware portfolios, investors should explore municipal bonds with slightly longer than average durations, including a modest allocation to high-yield municipal bonds. Trust portfolios should consider reinsurance investments.

Haworth says its important investors build and maintain their equity allocation, though they should be prepared for some market volatility following the S&P 500’s two consecutive years of 25%+ total returns. “With bond yields rising, equity price-to-earnings multiples have declined, putting some pressure on stocks.” In this environment, dollar-cost averaging can help mitigate risk by shifting funds into longer-term assets systematically over time. “This helps avoid the potential regret of investing a lump sum at the ‘top’ of the market,” says Haworth. He also suggests that real assets, such as real estate, offer an opportunity to protect against the impact of persistent inflation.

“Investors often pull money intended to achieve long-term goals out of markets after prices have already declined, then are hesitant to get back in until the markets have already recovered,” says Paul Springmeyer, senior vice president and regional investment director at U.S. Bank Private Wealth Management. This was true of investors who stayed out of the stock market in 2023 and 2024, as the S&P 500 frequently topped new highs.6

Springmeyer says for many investors, keeping long-term money on the sidelines turns out to be counterproductive. “It’s important to stay invested for the long-term to capture the opportunities that equities and bonds ultimately generate, without having to make decisions about whether the time is right to get into the market.”

Haworth also notes that along the way, changes may be appropriate. “It’s important to regularly rebalance a portfolio to reflect how market performance has changed your asset mix and bring it back to the intended allocation based on your risk tolerance, time horizon and goals,” he says.

It is not possible to predict with accuracy what to expect of the equity and bond markets in the near term. But those with long-term financial goals should seek reasonable opportunities to put cash to work consistent with their objectives, investment time horizon and risk tolerance.

Review your financial plan with a wealth professional and explore cash management opportunities – along with your long-term investing goals – to help you effectively position assets in today’s changing interest rate environment.

Note: The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.