Mortgages after retirement: Here’s what to know

10 ways to increase your home’s curb appeal

DIY home projects 101: tips from a first-timer

Is it the right time to refinance your mortgage?

6 questions to ask before buying a new home

Should you buy a house that’s still under construction?

5 things to avoid that can devalue your home

What is a home equity line of credit (HELOC) and what can it be used for?

What is a mortgage?

What you need to know about renting

8 steps to take before you buy a home

Military homeownership: Your guide to resources, financing and more

What is refinancing a mortgage?

Are professional movers worth the cost?

Building a dream home that fits your life

What to know when buying a home with your significant other

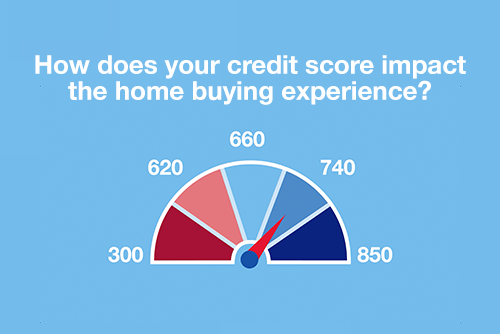

Mortgage basics: How does your credit score impact the homebuying experience?

Mortgage basics: 3 key steps in the homebuying process

Mortgage basics: How much house can you afford?

Mortgage basics: Buying or renting – What’s right for you?

Mortgage basics: Prequalification or pre-approval – What do I need?

How you can take advantage of low mortgage rates

Mortgage basics: Finding the right home loan for you

Quiz: How prepared are you to buy a home?

Home buying myths: Realities of owning a home

Uncover the cost: Home renovation

Mortgage basics: What is refinancing, and is it right for you?

Tips for realtors to help clients get their homeownership goals back on track

How I did it: Bought a home without a 20 percent down payment

5 ways to maximize your garage sale profits

Putting home ownership within reach for a diverse workforce

What’s the difference between Fannie Mae and Freddie Mac?

How jumbo loans can help home buyers and your builder business

Simple steps to be ready for a natural disaster

Checklist: financial recovery after a natural disaster

Pros and cons of a personal line credit

3 tips for saving money when moving to a new home

What’s a subordination agreement, and why does it matter?

Checklist: 10 things to look for when touring a home

How to sell and buy a home at the same time

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Mejoras de vivienda con el mejor rendimiento de inversión (ROI)

Overcoming high interest rates: Getting your homeownership goals back on track

How we did it: Converted to solar power

PCS moving checklist for military spouses and families

For today's homebuyers, time and money are everything

Crypto + Homebuying: Impacts on the real estate market

How I did it: Bought my dream home using equity

Buying a home Q&A: What made three homeowners fall in love with their new home

House Hacks: How buying an investment property worked as my first home

Managing the impacts of appraisal gaps in a hot housing market

How I did it: Built living spaces to support my family

Spring cleaning checklist for your home: 5 budget-boosting tasks

Saving for a down payment: Where should I keep my money?

Your guide to breaking the rental cycle

Checklist: 6 to-dos for after a move

What are conforming loan limits and why are they increasing

Uncover the cost: Building a home

The lowdown on 6 myths about buying a home

4 ways to free up your budget (and your life) with a smaller home

Get more home for your money with these tips

Money Moments: Tips for selling your home

Momentos Financieros: Cómo financiar una ampliación de la vivienda

How I did it: My house remodel

First-time homebuyer’s guide to getting a mortgage

Dear Money Mentor: When should I refinance a mortgage?

Beyond the mortgage: Other costs for homeowners

10 questions to ask when hiring a contractor

What is an escrow account? Do I have one?

These small home improvement projects offer big returns on investment

Should you get a home equity loan or a home equity line of credit?

Mortgage basics: What’s the difference between interest rate and annual percentage rate?

Is a home equity line of credit (HELOC) right for you?

How to use your home equity to finance home improvements

How does a home equity line of credit (HELOC) work?

Home equity: Small ways to improve the value of your home

Can you take advantage of the dead equity in your home?

4 questions to ask before you buy an investment property

10 uses for a home equity loan

Improving your credit score: Truth and myths revealed