Overcoming high interest rates: Getting your homeownership goals back on track

4 questions to ask before you buy an investment property

Did you know that you can lose equity by how you treat your home? Here are five things to avoid.

Home equity is the difference between the value of your home and what you owe on your mortgage.

You can build equity by paying down your mortgage – but did you know that you can lose equity by how you treat your home?

Here are five things to avoid that could reduce the value of your home.

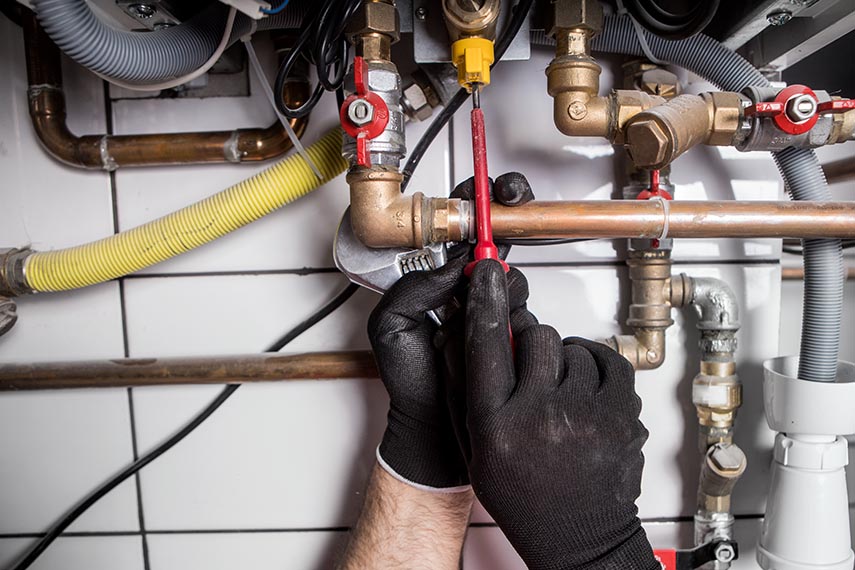

1. Rough renovations

Renovation projects are likely the first thing that comes to mind when people think about increasing equity. It’s true that putting money into good renovations is a solid investment and will raise your home’s value, but there is a vital emphasis on these being good renovations. A project gone wrong can make your home look worse, and in some situations, like a DIY mess. Prospective buyers will see these renovations as something they’ll have to redo, rather than a selling point for the home. So plan your projects carefully and enlist professional help if needed. And make sure you do your homework before hiring a contractor.

2. Unusual renovations

Along with poor-quality renovations, getting an unusual renovation can also lower your equity. Kitchen and bathroom renovations usually have the highest impact, but only if potential buyers will find them attractive and functional. The secret lies in simplicity and mass appeal. In kitchens, it’s safest to stick with renovations to the sink, countertops and cabinets. In the bathroom, invest in neutral, pleasant flooring and fixtures, and express your individuality with decorative accents.

3. Extreme customization

It’s your home, so you’re free to express your personality in the interior however you’d like. But when you’re trying to sell, consider that your personal tastes could be different from those of some buyers. Prospective buyers like to visualize their own lives and belongings in a house, and that’s difficult if the interior is highly customized. You don’t need to paint every wall hospital-white, but put yourself in a buyer’s shoes and choose neutral colors and décor likely to appeal to a wide range of people. And remember, the darker the color you put on a wall, the more work it is for a potential buyer to cover it with their preferred color.

4. An untidy exterior

The exterior is the first part of your home that potential buyers will see. If your yard is in serious need of some weeding or trimming, it will make your house look messy and give buyers the impression that the yard will require a lot of upkeep. Old fences, worn siding and peeling paint all give buyers the impression of future improvement projects of the less-fun variety. If you’re ready to list your house, keep your exterior free of extraneous items like kids’ toys during open houses and private showings. Learn some quick ways to boost your home's curb appeal.

5. Skipped daily upkeep

Performing routine maintenance plays a large part in preserving your home’s value and can even increase its equity. Devise a home maintenance schedule and stick to it. Even simple tasks like regularly changing your furnace filter can make a difference in your home’s condition and value.

Ready to put your home equity to work for you? Use our home equity calculator to get your estimate and to learn more about home equity options.

Related content