“It can be beneficial to broaden your investments and sources of cash flow,” says Tom Hainlin, national investment strategist at U.S. Bank Asset Management. Hainlin adds that because of the unpredictable nature of capital markets, “it’s important to develop a strategy that avoids drawing down principal at the beginning of retirement. Once spent, those assets can no longer generate the growth necessary to last through retirement.”

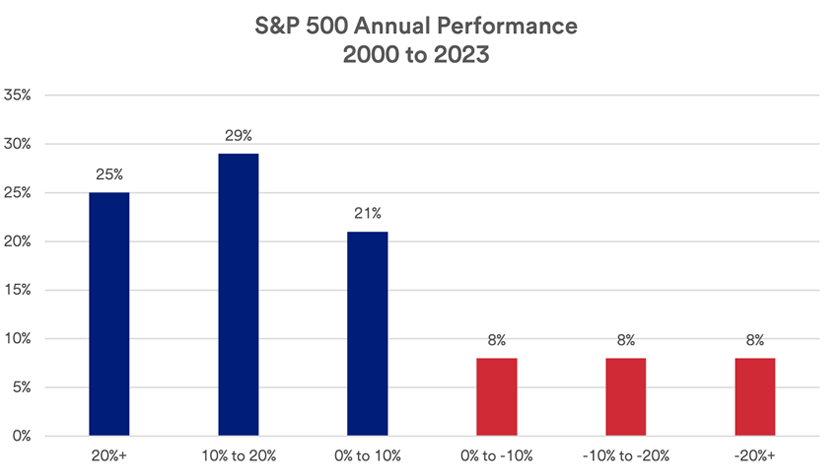

Haworth adds that as investors structure a portfolio balanced between equities and fixed income, they can capitalize on a more favorable interest rate environment. “There are strategies within the bond market, including more complex securities like structured credits, that offer ways to generate meaningful, extra income,” says Haworth. Haworth notes that given strong 2023’s and 2024’s strong stock market performance, investors should consider portfolio rebalancing to more accurately reflect their risk profile.

Balance sequence of returns risk with a retirement bucket strategy

“Retirement is a long runway, and you still need growth in your assets,” Baustian says.

One income strategy to consider is a retirement bucket strategy, where you set aside a portion of your assets to meet your needs through various phases of your retirement. Baustian notes that financial professionals often look at ways to separate retirement assets into three “buckets” with the aim of avoiding selling assets that can fluctuate in value and are subject to loss in a down market.

- Liquidity (immediate needs). This bucket carves out assets to meet your day-to-day needs for the first three to five years of retirement. This money should be kept in more liquid assets with minimal exposure to market fluctuations, such as cash-equivalent investments (CDs, money market accounts) and short-term bonds.

- Lifestyle (short-term savings goals). You can invest a portion of your assets more aggressively to meet your needs for years three to 10. “Use a disciplined asset allocation strategy with these investments so they can continue to grow,” Baustian says. “Some of the money is regularly shifted to replenish the ‘liquidity’ bucket.”

- Legacy (long-term planning). “The dollars in this bucket can be invested with future generations or key charitable causes in mind,” Baustian says. “There may be more flexibility to invest these dollars in assets outside of traditional stocks and bonds.” You can hold this money until the latter part of your life.

Planning for sequence of returns risk is part of your broader retirement preparation

There are plenty of tasks to check off your retirement list.

“You should consider starting to position your assets for retirement about two to three years before you reach that date,” Baustian says. “It can even be initiated five years out. You’ll want to evaluate all the potential sources of income available to you.” These include Social Security, contributions from company pensions and deferred compensation.

Even before that, you should build a diversified portfolio that better weathers market volatility before and during retirement. This should include with a mix of investments, such as bonds, equities and diversified investments, that aligns with your risk tolerance.

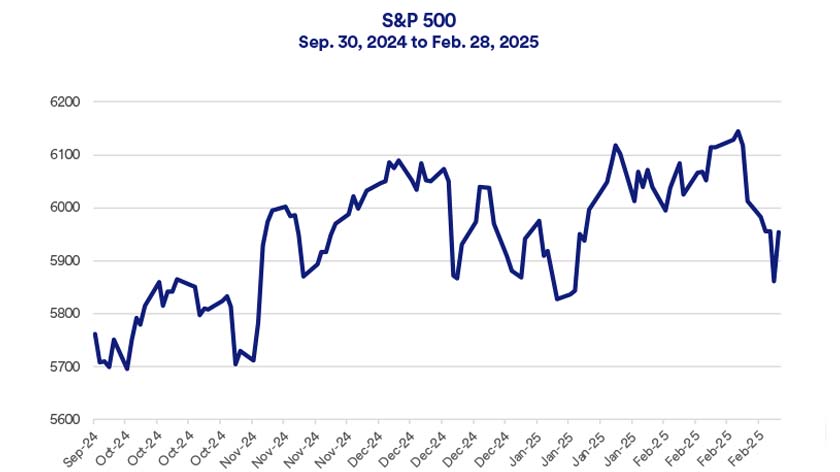

As your retirement date approaches, evaluating sequence of returns risk becomes critical. “Understand what your investment portfolio is exposed to that could put your long-term financial security at risk in the event markets move in an unanticipated direction,” Hainlin says.

He adds that it’s important to maintain a degree of flexibility. “Of course, increased life expectancy is a welcome social development, but it creates significant challenges in terms of the increasing costs of retirement over time,” he says. “Add to that the potential for unpredictable markets, and retirees need to be willing to make adjustments over time to maintain their long-term financial security.”

Learn how we can help you plan and create a retirement income strategy that accounts for sequence of returns risk.