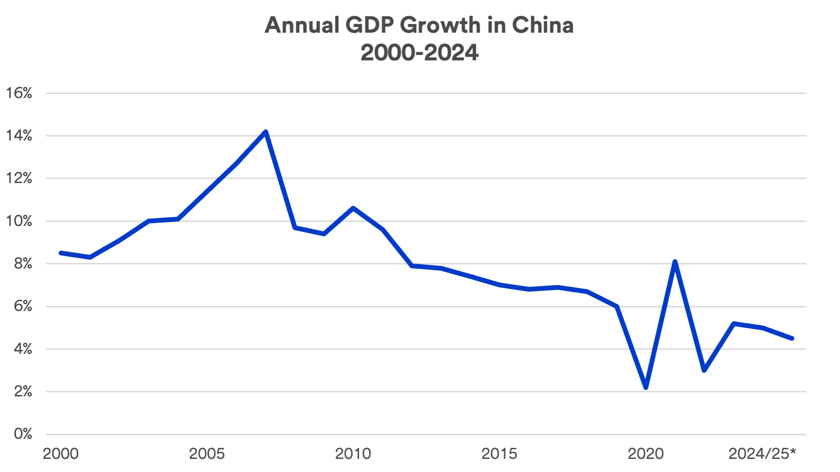

Despite current headwinds, China’s economy expanded at an annualized rate of 5.3% in 2024’s first quarter, slightly ahead of expectations.1 However, this represents a significant change for China’s economic trajectory compared to the first part of the 21st century. “China is gradually transitioning from its emerging market stage to a developed market stage, where growth will be slower than was the case in recent history,” says Haworth.

How do developments in China affect global markets today, and how should you assess investment opportunities based on China’s economic growth?

China’s economic challenges

Significant property sector challenges and export weakness are major contributors to China’s economic malaise. New home prices faced their steepest decline last year since early 2015.2 Property investment fell 10.1% on a year-over year basis from January to May 2024. Average new home prices have declined for 11 consecutive months.3 Exports, an important linchpin for China’s economic growth, fell 4.6% in 2023, the first annual decline in export activity since 2016.4 More encouraging data emerged in early 2024, with China’s exports growing 7.6% in the one year period ending in May 2024.5 Despite recent weakness, China remains the largest global exporter of manufactured goods.6 However, ongoing trade battles with the U.S. and other countries aren’t likely to help boost exports.

At the same time, slowing domestic demand remains a challenge. “One reason for concern about China’s property weakness is that consumers have limited savings, having spent it down during the pandemic, and much of their wealth tied up in housing, which has dropped in value. So they are not in a strong position,” says Haworth.

China’s economic reopening

China’s economic recovery was slow to emerge since it eliminated its zero COVID policy in late 2022. China’s growth of 5.2% in 2023 exceeded the previous year’s 3.0% but is still considered lagging by historical standards.7 The latest indicators, it appears China’s GDP may be on a slower growth trajectory than was the case for much of the last two decades. “Chinese consumers are still focused on rebuilding savings they spent down during COVID-related shutdowns. They are holding off on buying things like durable goods,” says Haworth.