Key takeaways

Real estate investment trusts (REITs) allow you to invest in real estate without owning the properties.

There are two main classes of REIT: equity REITs and mortgage REITs.

REIT investments come with risks, including fluctuating demand for certain types of properties.

Real estate has long attracted investor interest as a portfolio diversification tool. While direct ownership of residential and commercial properties is one way to get into real estate, investors today can tap into much more practical and accessible approaches. Real estate investment trusts (REITs) are an increasingly popular option for many. Real estate can be an important asset class to consider for a broadly diversified portfolio.

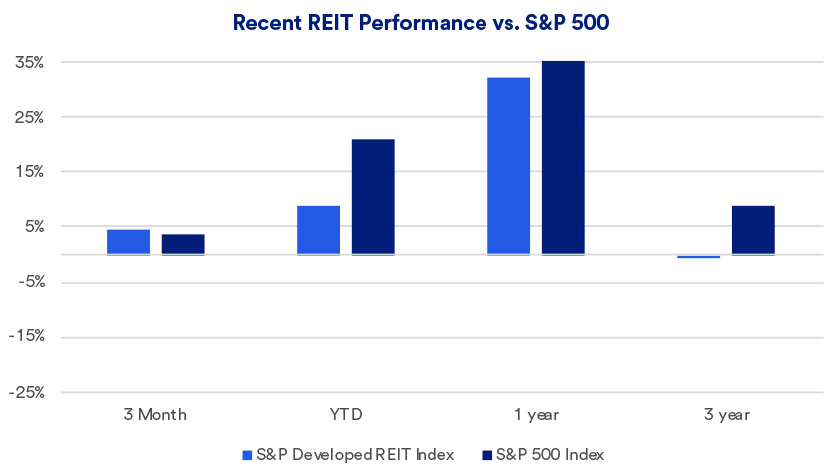

REITS underperformed the broader market in recent years, though in 2024’s second half, they generated better returns. “Real estate in general looks like a reasonably attractive sector based on where things stand as the year comes to a close,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management.

What is a REIT?

A REIT is a corporate entity that holds real estate-related assets in a portfolio. Like a mutual fund, it’s an investment vehicle that pools investors’ capital. Professional managers then invest assets, and investors receive a pro-rata share of the REIT’s return.

However, rather than purchasing stocks or bonds, a REIT owns, operates or finances income-producing properties. To be classed as a REIT, the trust must meet specific requirements, says Kevin Weigel, portfolio strategist at U.S. Bank Wealth Management.

“For example, it has to pass through 90% of the income generated from whatever the business activity is — whether it's owning properties or financing properties — as dividends to the investors,” he says. “The entity itself is a tax-free entity. All the income gets taxed at the investor level through dividend taxation.”

“Equity REITs can be a good diversifier to a normal equity portfolio, and mortgage-backed REITs can be a good way to diversify a traditional bond portfolio.”

Kevin Weigel, portfolio strategist at U.S. Bank Wealth Management

Types of REITs

There are two broad types of REITs: equity and mortgage.

- An equity REIT buys or invests in properties. It holds buildings in its portfolio and passes through rental income, less operating expenses, to the investors.

- A mortgage REIT finances properties for income-producing real estate, purchasing or originating mortgages. Investors are the debt holders. “The debt is secured by the property,” says Weigel. “Investors hope the property doesn't decline in value, which would cause a write down on the mortgage or corporate bond.”

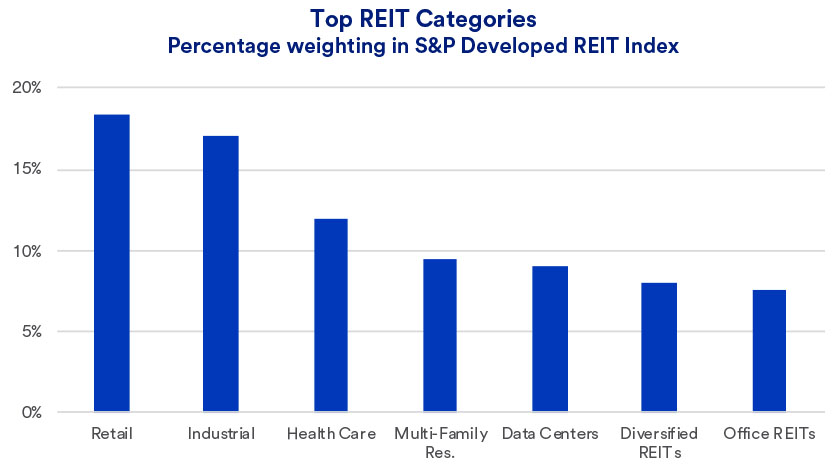

There are also sub-categories of REIT investments. For example, an equity REIT may focus on traditional real estate segments, such as office buildings, retail centers, industrial properties and apartments (multi-family residences). It could also focus on specialty properties like cell towers, data centers and self-storage facilities. As shown in this breakdown of the largest categories of REITs in the S&P Developed REIT Index, it is a well-diversified marketplace.

Mortgage REITs can also specialize in a sub-category. For example, the REIT may make loans on individual buildings or commercial mortgage-backed securities. It could own Fannie Mae or Freddie Mac mortgage-backed securities. Or it could focus on non-agency subprime mortgages.

How to invest in REITs

Weigel says investing in REITs is quite simple. “Whether it's an equity REIT or a mortgage REIT, it has a ticker symbol,” Weigel says. “It's similar to investing in shares of stock, and most REITS are actively traded.”

Most REITs are publicly traded and listed on the major stock exchanges, like the New York Stock Exchange and NASDAQ. You can also purchase REIT shares in a mutual fund or exchange-traded fund (ETF). You can make the purchase yourself or through the help of a broker.

You may want to consider working with a financial professional, who can review your existing investments, risk profile and liquidity needs to help determine if REITs would enhance your portfolio, as well as what specific REIT types.

REIT performance

Real estate provides a risk profile different from other asset types, such as stocks and bonds. In addition, the market often responds to economic events differently. As a result, understanding how REITs perform in various economic conditions can help you more effectively manage risk in your portfolio.

Weigel says REIT investments typically do well in an environment with some economic growth. “A steady or decelerating inflation environment where interest rates are dropping is best,” he says. “For example, if you have an apartment REIT, then any time the economy is growing, people have jobs and their incomes are growing, the landlord probably can increase rents.”

On the other hand, in the office or warehouse markets, which typically feature longer-term leases, landlords may not be able to adjust the rent as quickly.

A slowing economy with rising mortgage rates could also affect property values and income generated by REITs. While yields generated by REITs can be competitive, the income stream can be volatile and less steady than income generated from an asset class like utility stocks.

When, in 2021, interest rates remained low, REITs enjoyed solid performance. Beginning in early 2022, as interest rates began moving higher, REITs faced headwinds. REITs underperformed the broad S&P 500 Index in 2023 and again over 2024’s first six months, but as interest rates trended lower, REITs bounced back.

“2024 REIT performance has really been about interest rates,” says Haworth. “REITs rebounded in mid-year as 10-year U.S. Treasury yields declined. Then, in mid-September, when interest rates reversed course and moved up again, REITs lost ground.”

Yet Haworth notes that not all REITs perform the same. “There are secular growth stories that benefit from current economic trends,” according to Haworth. “Light industrial and logistics companies are growing due to increased use of home delivery. Data centers and cell towers are benefiting because we’re pushing more data through the system.” These factors indicate that investors may want to be selective in making REIT allocations.

What are the risks of REITs

As with any type of investment, REITs come with risks. “There's no guarantee that properties are always going to increase in value,” Weigel says. “In an economic downturn, if the property loses enough tenants and the rent rolls decline, the value of the properties will decline. It could be compounded if they have mortgages on them.”

There are also property-specific risks. “Offices have been problematic since COVID and the rise of working from home,” says Weigel. “Companies are still trying to figure out what kind of footprint they need for their employees.”

He explains that office leases tend to run for multiple years, so an office property might be generating significant rental income currently, but with only 50% of employees working in the office. Once the leases end, tenants might decide they only need half the space, resulting in a decline in rents, and rental income, for office properties over a longer time horizon.

“There's no guarantee that a property type is going to be in demand in the future,” Weigel says. In terms of office REITs, Haworth notes that they make up approximately 5% of the REIT marketplace.

Investing in REITs helps diversify your portfolio

The REIT structure enables investors to access an asset class they likely couldn't buy on their own and get it in a diversified form across geographies, sizes, types and business districts.

“Equity REITs can be a good diversifier to a normal equity portfolio, and mortgage-backed REITs can be a good way to diversify a traditional bond portfolio,” says Weigel.

Real estate has long been a popular investment vehicle, and there isn't a one-size-fits-all approach. REITs offer a potential opportunity to expand your portfolio, incur capital appreciation and generate dividend income without holding the asset.

Learn about our approach to investment management.

Tags:

Related articles