Key takeaways

If your workplace 401(k) plan allows for after-tax 401(k) contributions, you can invest post-tax dollars beyond the annual elective deferral limit and set aside more money for retirement.

Contributions grow tax-free, but earnings are subject to ordinary income tax rates upon withdrawal.

If you leave your employer, you can rollover after-tax contributions to a Roth IRA to continue growing these funds tax free. Any earnings would need to be rolled over to a traditional IRA.

What if you’ve contributed the maximum amount of pre-tax (and/or Roth) dollars to your employer-sponsored 401(k) plan, but you still want to grow this fund for retirement?

“In some cases, it’s possible to make after-tax 401(k) contributions beyond and outside of your pre-tax and/or Roth 401(k) contributions and employer match,” says David Britton, Senior Wealth Planner with U.S. Bank Private Wealth Management. “These contributions can be an opportunity for high earners to further grow their retirement savings.”

What is an after-tax 401(k) contribution?

After-tax 401(k) contributions are post-tax dollars you invest in an employer-sponsored 401(k) plan above and beyond your annual effective deferral limit.

“Making after-tax contributions into your 401(k) to be later rolled over into a Roth IRA would be a great strategy for you to put more money away now so you can maximize a tax-efficient retirement bucket later.”

David Britton, Senior Wealth Planner, U.S. Bank Private Wealth Management

Because the money you invest has already been taxed, earnings grow tax-deferred, like they do with a Roth 401(k). But unlike a Roth 401(k), where qualified distributions aren’t subject to income tax, earnings on after-tax 401(k) contributions are taxed as ordinary income on withdrawal.

Not all workplace retirement plans allow after-tax 401(k) contributions, but a growing number do – which presents an opportunity for high earners to put more money toward retirement in a tax-efficient manner.

How after-tax 401(k) contributions work

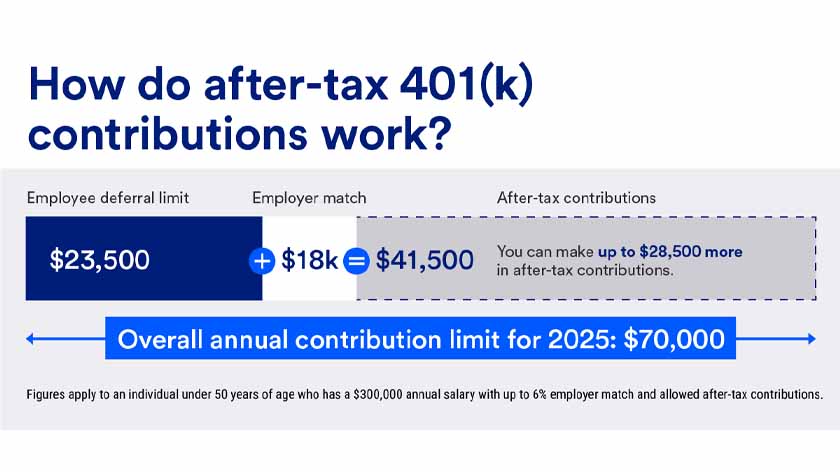

The annual elective deferral limit for an individual’s pre-tax 401(k) contributions – or Roth 401(k) contributions, if eligible – is $23,500 in 2025. If you’re age 50-59 or 64 and older, you can make an additional $7,500 in catch-up contributions. Note that beginning in 2025, due to a provision in the Secure 2.0 Act, employees age 60-63 can contribute up to $11,250 in catch-up contributions.

If your employer’s retirement plan allows after-tax 401(k) contributions, however, it brings the total allowed contribution, including employer match, to $70,000 per year, plus more for those 50 or over.

One benefit of after-tax contributions to your workplace 401(k) is that you can withdraw them free of tax or penalties. However, any money you earn from those after-tax contributions is considered pre-tax, so you’ll pay tax if you withdraw any of those earnings unless you roll them over into an IRA. If you’re not yet 59 ½, you might also have to pay a 10% penalty.

What’s more, the option to make after-tax contributions within an employer-sponsored 401(k) plan does not have an income limit, so regardless of what you earn, you can participate if your employer offers the plan.

Note that withdrawal rules vary from plan to plan. For example, you might not be able to make withdrawals until you leave your employer. If your employer’s plan does allow withdrawals, the rules could be complicated, so it’s a good idea to consult a financial professional to make sure you understand the implications.

Making the most of after-tax 401(k) contributions

Even if your employer offers this option, it won’t be right for everyone. Here’s what you should know about taking advantage of after-tax 401(k) contributions.

When should you make after-tax 401(k) contributions?

The smartest way to use after-tax 401(k) contributions is after you’ve maxed out your pre-tax 401(k) and/or Roth 401(k) contributions, which are more attractive retirement investment options from a tax perspective.

You aren’t required to wait until you’ve hit your annual effective deferral limit, but it’s important to make sure any after-tax contributions you make don’t stop you from investing the full allowable amount in pre-tax and/or Roth accounts.

How to invest after-tax contributions: Three paths

- Keep the money where it is. You could keep your after-tax contributions in your employer 401(k) and simply pay tax on the earnings when you withdraw them. As mentioned above, not all workplace plans will let you make withdrawals until you leave the company or retire, so be sure to understand both IRS rules and those of your workplace plan.

- Move contributions to a Roth account. You can rollover your after-tax contributions to a Roth IRA, if your employer’s plan allows it, and enjoy tax-free withdrawals during retirement. “Within the Roth IRA, the subsequent earnings on those funds remain tax-free,” says Britton, “as long as the withdrawals take place after you reach 59 1/2 years and after reaching the five-year holding period.”

- Move earnings to a traditional IRA. “Earnings on after-tax contributions will need to be rolled over to a traditional IRA, because they have not yet been taxed,” Britton says. This allows you to defer paying taxes on traditional IRA withdrawals until retirement.

Roth vs. after-tax 401(k)

If you decide to rollover your after-tax contributions to a Roth IRA, there is a way around the five-year withdrawal waiting period. While you can’t open a Roth IRA directly if your income is too high – 2025 limits are $165,000 if filing single or $246,000 if married filing jointly – you can open a traditional IRA and then immediately convert a nominal amount, say $1,000 or even $100, to a Roth IRA, which will start the five-year clock. This is called a backdoor Roth IRA. Be sure to consult with your tax advisor to discuss the backdoor Roth IRA strategy including “basis aggregation rules” that may exist.

Tax implications of after-tax 401(k) contributions

The most important thing to remember about after-tax contributions to an employer-sponsored 401(k) is that contributions grow tax free, but earnings are taxed at ordinary income rates when you withdraw them.

Whether you leave after-tax funds in your employer’s plan or roll it over to a Roth IRA and/or a traditional IRA should depend on your overall tax strategy, your timeline and your retirement plan.

“That’s really the first question that should be asked: What's the need for that dollar once it's invested? And then you can decide where to put it in the most tax-efficient manner,” Britton says.

You should consult a tax professional before making after-tax 401(k) contributions to make sure this tactic fits in with your overall financial strategy.

Are after-tax 401(k) contributions right for you?

The strongest case for making after-tax contributions to your 401(k) plan is to maximize the tax-advantaged Roth IRA provisions within the tax code, according to Britton.

“Currently, we have historically low tax brackets, but those are scheduled to sunset in 2026 if Congress doesn't do anything, and there is concern that tax rates will rise for individuals in the higher bracket,” he says. “So, making after-tax contributions into your 401(k) to be later rolled over into a Roth IRA would be a great strategy for you to put more money away now so you can maximize a tax-efficient retirement bucket later.”

Learn how we can help you create a plan to grow and protect your wealth.