Key takeaways

Tax loss harvesting is when you sell securities for less than their cost basis to offset realized capital gains in other areas.

Tax loss harvesting can be used in many situations, including when rebalancing your portfolio and trying to stay in a lower tax bracket.

Tax loss harvesting is a complex strategy, so getting advice from a financial professional is important.

Buy low and sell high. It’s the universal strategy for investing. With major stock market indices down significantly in 2022 due to factors like high inflation, rising interest rates and supply chain constraints, a portion of your portfolio may be in the red. Tax loss harvesting is a strategy that may provide some relief from investment losses by potentially reducing your tax liability.

“Because of the increased volatility in the marketplace, investors who have realized gains may prefer to not remain in a particular position,” says Amit Poddar, senior vice president and market leader for U.S. Bank Private Wealth Management. “They may also want to increase their cash and liquidity position. Or, opportunistically, they may want to capture as much of the gains as they can in hopes of buying back into the market at an appropriate time. That's where tax loss harvesting comes into play.”

Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains you may have realized in other investments.

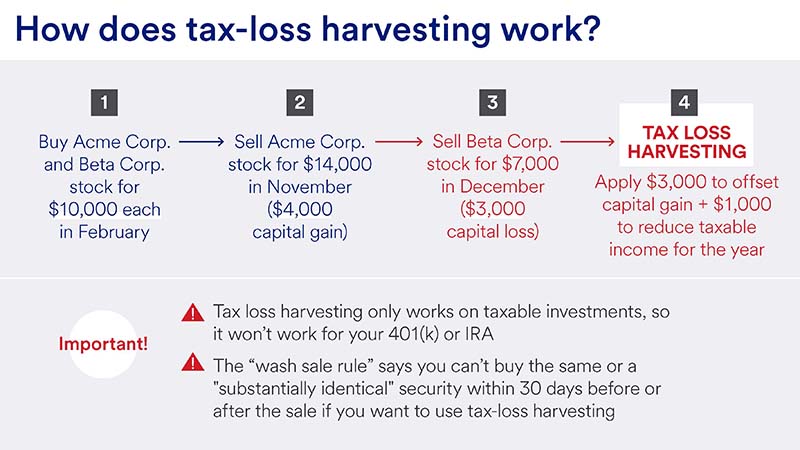

How does tax loss harvesting work?

Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains you may have realized in other investments, including the sale of real estate, a business or another large asset.

How you match your losses to gains depends on how long you held the assets. Typically, short-term losses—those you held for 12 months or less—are used first to offset short-term gains, and long-term losses of assets held for more than a year are used to offset long-term gains. If you have losses beyond the matching approach, you’re then allowed to apply short-term losses to long-term gains and long-term losses to short-term gains.

Tax loss harvesting example

Let’s say you own shares of Acme Corp. stock and Beta Corp. stock, both held for less than 12 months. If you sell Acme Corp. stock and realize a profit, that profit would be subject to short-term capital gains tax (which is higher than the long-term capital gains tax). You could offset some of that tax liability by also selling shares of your Beta Corp. stock for less than what you paid for them.

The realized short-term capital loss of your Beta stock can be used first to offset the short-term capital gains realized on the sale of your Acme stock. Then, any excess can be used to offset up to $3,000 of your ordinary taxable income ($1,500 for those who are married filing separately). Any amount over $3,000 can be carried forward to subsequent years and used subject to the “passive loss” rules.

“In an ideal scenario, you want to take your losses and offset your short-term capital gains, since they’re taxed at a higher rate,” says Poddar.

But there’s a caveat. If you take a loss, you must stay out of that stock for a month to avoid violating the “wash sale rule.” If you buy back into the position of previously purchased stock within 30 days of its sale, you can no longer claim that loss on your taxes. Instead, under the “wash sale rule,” the loss will be added to the newly acquired stock’s cost basis.

Is tax loss harvesting worth it?

The potential for tax loss harvesting benefits will be specific to your financial situation. Here are some situations where tax loss harvesting might be useful. Given the need for proper coordination and compliance with complex tax rules for the desired result, it is imperative that qualified financial and tax professionals be consulted prior to implementation.

Rebalancing a portfolio in an up vs. down market.

“Part of the concern in an up market is balance,” says Poddar. “Rebalancing in an up market will incur capital gains, which becomes a decision based on the tax load. If you have a few positions with losses, hopefully you have some positions that have gains, and it would be a good time to rebalance to incur the minimum amount of capital gains.”

Converting a traditional IRA or 401(k) to Roth.

A down market is a good time to transfer funds from a traditional IRA or 401(k) plan to a Roth account. You will recognize taxable ordinary income on the amount converted, but that amount may be smaller in a down market and you’ll owe less in taxes. You can leverage tax loss harvesting here, too, taking a loss to offset at least part of the gain up to the allowed limit against ordinary income, keeping more of your money. This strategy would be especially beneficial to a young investor with a longer time horizon for the Roth to grow.

Staying in a lower tax bracket.

Investors who are on the cusp of an income tax bracket could opt to take a loss to reduce their adjusted gross income (AGI) and stay within the lower bracket. Taking a loss to reduce your AGI might also put you within the income level to make a Roth IRA contribution or take advantage of other deductions.

If you have significant assets.

High and ultra-high net worth individuals are accustomed to thinking about capital gains and losses. They often have multiple types of assets in the form of investments, businesses or a portfolio of properties they may want to sell. Tax loss harvesting can become important to offset gains.

If you’re nearing retirement.

If you hold a significant amount of company stock in your retirement plan, combining tax loss harvesting with net unrealized appreciation (NUA) planning can be an effective strategy to reduce taxes. “If you have a concentrated position or don't think the stock is going to continue to do well and you want to diversify out of it, you can identify other stock positions in your taxable account that have experienced significant losses that you want to sell and use the realized capital losses to offset some of the realized capital gain on the subsequent sale of some of your company stock,” says Poddar.

When should you harvest tax losses?

While tax loss harvesting can be done at any time, most investors choose to use this strategy near the end of the year, once they have a better idea of their portfolio performance and start planning to file their taxes. Poddar cautions investors to start the process sooner rather than later.

“We see a lot of investors who want to capture losses between Christmas and New Year,” he says, adding it pays to know when the last day to execute the sale of your positions for tax loss is. “Start thinking of harvesting in the fall and start executing a chosen plan much ahead of the late December deadline.”

Tax loss harvesting can be beneficial. It’s also nuanced and complex. Before selling assets, talk with a financial or tax professional to determine if a tax loss harvesting strategy is right for you.

Learn about our approach to investment management.