You can do this at any time during your draw period – that’s the time between opening the HELOC up until your repayment begins.

What’s a fixed-rate option for a HELOC?

Once you close on a HELOC, you have the option to lock in a fixed interest rate for up to 20 years on some or all of the money you borrow. That way, if interest rates rise in the future, your fixed-rate option(s) won’t.

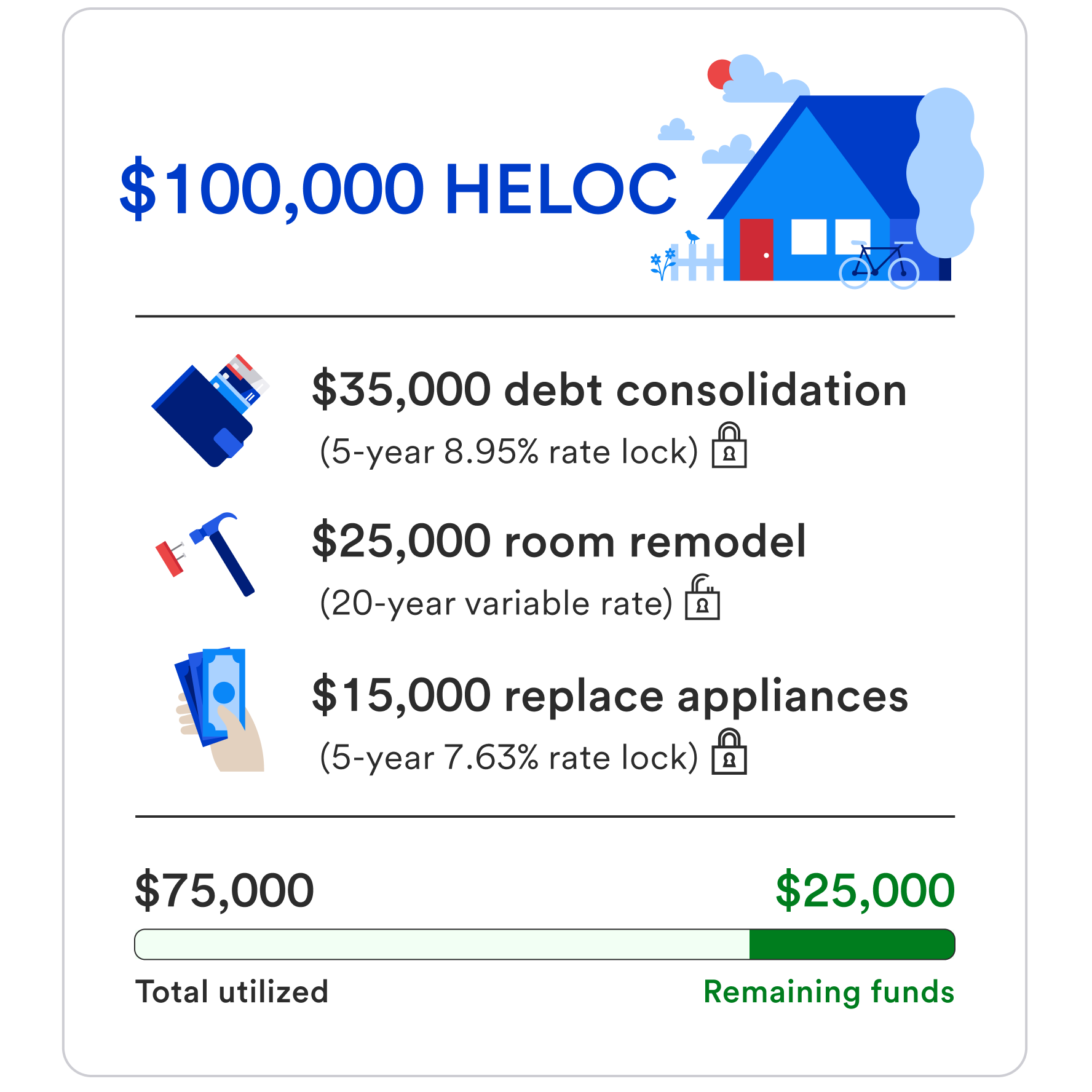

An example of a HELOC with fixed-rate options

- Open a $100,000 HELOC.

- To consolidate your debt, you draw $35,000 and you’re able to lock in a 8.95% APR.

- Next, you choose to remodel a room. Since you aren’t sure how much money you’ll need for the total project, you can’t lock in a rate. You end up drawing $25,000 over time at a variable (or unlocked) rate.

- To finish the room, you need new appliances. Since you know the total will be $15,000, you draw that much from your HELOC and lock in a 7.63% APR.

- You have now utilized $75,000 from your HELOC and have $25,000 available.

All rates shown are for example only.

Don’t have a HELOC yet? Start your application.

The process for getting a HELOC is simple. You’ll need to complete a basic application, submit any requested documentation and, if approved, close at a branch.

Ready to lock in a rate on your existing HELOC?

View our step-by-step guide to lock a fixed rate.

Our U.S. Bank self-service tool makes it even easier to manage your HELOC and lock or unlock rates on your own. Check out this video to learn how.

Step 1

Log in to mobile or online banking.

Step 2

Select your HELOC account.

Step 3

Choose to lock or unlock a fixed rate.

Step 4

Select the amount you want to lock in, along with the term and rate.

Get answers to frequently asked questions about fixed-rate options for a HELOC.

Take the next step

Start of disclosure content