Investment strategies by age

How to start investing: A beginner’s guide

Compound growth is an incredibly simple but powerful financial phenomenon that can help you meet your investment goals. Here’s how it works, what affects it and how you can make the most of it in your investing strategy.

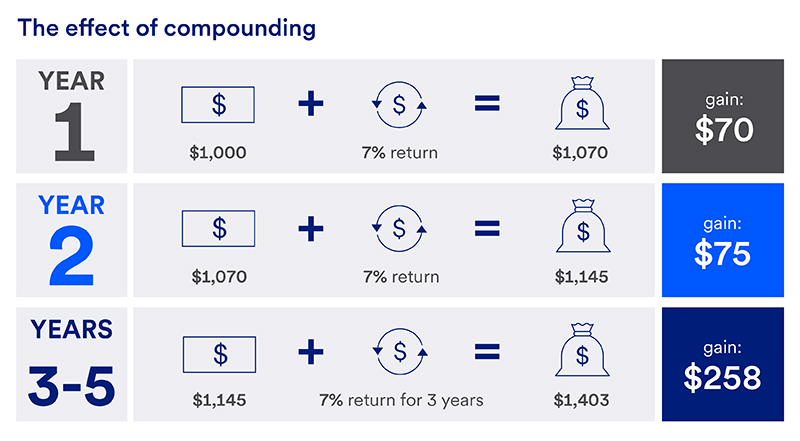

When you make an investment, you hope it earns a return. For instance, a $1,000 investment might return 7% in year one, for a total gain of $70. The next year, you could reinvest the $70 gain for a total investment of $1,070. If that investment once again returned 7%, you’d end up with $1,145—a gain of $74.90. That’s because the $70 in returns from year one compounded to give you an extra $4.90.

Therein lies your opportunity: The return on your investment generates its own return. Said more simply, through the power of compounding, even your interest earns interest. This effect can grow stronger with time.

Now, imagine the return after five years if you invest more than $1,000 initially. Or if you invest for 30 years instead of five.

Compound growth has the most impact on long-term investing since its effects increase as time goes on.

Using the previous numbers, let’s say you withdrew your returns every year instead of letting them compound in the investment account. In the example above, that would be a withdrawal of $70 each year.

Five years later, assuming a 7% return each year, you would have earned $350 in withdrawals instead of $403 in compound growth. After 10 years total, taking the returns each year without compounding would earn you $700. Letting your investment earn compound growth over 10 years would result in a gain of $968.

If you’re investing for a long-term goal like retirement, the way in which returns can compound significantly over time means you can do more with less.

There’s a formula you can use to calculate the compound growth rate of an investment, which is referred to as the compound annual growth rate, or CAGR. It requires three inputs: the investment’s end value, beginning value and the time period.

Here’s the formula:

CAGR = [(End value/Beginning value)^(1/# of years)-1]x100 = % growth

The single biggest way to benefit from compounding is to start investing as early as possible. If you want to retire with a certain amount of money, the earlier you start, the less you would have to invest initially. You may even be able to set aside less as you age and put more money toward other goals. The longer your investments have to compound, the greater the impact.

Here’s another illustration (again, using a yearly return of 7% as an example – see graphic below): Imagine you’re planning to retire at 70. If you invested your first $1,000 at age 40 and held it for 30 years, you’d have just over $7,613. If you had started at age 20, you’d have more than $29,458 at age 70 — and that’s without ever adding another penny.

The good news is even if you didn’t start early, you still have more time now than you will next year, or the year after that. The more you can put away today, the greater the opportunity for compounding to work.

One of the easiest ways to benefit from compound growth is to set up an automatic investing plan. As the name implies, this plan invests your money automatically at certain time intervals, such as each pay period.

Automatic investing is a common strategy for retirement saving. Here, you would have a certain amount of money automatically deducted from your pay and invested in your retirement plan each pay period. You can change the amount or frequency if your time horizon, investing goals or risk tolerance change at any point.

This strategy takes advantage of an investing concept known as buy-and-hold, or dollar-cost averaging, which tends to reduce the impact of market volatility on your portfolio and even out share prices over time. It also helps remove emotions from investing by taking the human element out of investing decisions, as well as the temptation to try to time the investment markets.

Want to learn more about investing? No matter your level of experience, we’ve got investing insights and advice to help you take your knowledge to the next level.