Non-retirement investing: Investment options outside of retirement accounts

How do interest rates work?

Most people understand that inflation increases the price of their groceries or decreases the value of the dollar in their wallet. In reality, though, inflation affects all areas of the economy — and over time, it can even take a bite out of your investment returns.

Understanding the relationship between inflation and your investments is essential to making informed investing decisions. Here’s a high-level look at the effects of inflation, how inflation affects demand and, specifically, how inflation affects stocks. For a deeper dive, read U.S. Bank expert analysis on inflation’s current impact on investments.

Inflation is when the average cost of goods and services increases over time, which leads to a decrease in your purchasing power. In other words, when inflation occurs, your money “buys less” over time.

Inflation can be calculated broadly — as the overall increase in the cost of living — or for specific items, such as the cost of gas, groceries or housing.

A variety of factors can influence inflation, namely:

Another, less-tangible reason is psychological in nature: consumer expectation, which is sometimes called built-in inflation. In this situation, if a period of inflation lasts long enough, people might expect it to continue indefinitely. They could start asking their employers for wage increases to help them keep up with the higher cost of living. Companies might then increase the prices they charge consumers, which would fuel inflation further.

High inflation can have negative consequences on the economy. As prices rise, your purchasing power decreases — meaning the same amount of money buys you less. In general, this leads to a slowdown in economic activity, including these changes in consumer spending behavior:

Inflation can shrink your savings even if you’ve secured your funds in a savings account with an average interest rate. For example, inflation affects how much your retirement savings are worth.

In theory, when you’re working, your earnings should keep pace with inflation. When you’re living off your savings, inflation diminishes your buying power.

It’s important to monitor your savings against inflation to ensure you have enough assets to last through your retirement years. For example, if you’re retired now and currently need $45,000 per year to sustain your lifestyle, and the annual inflation rate is 3%, in 30 years you’ll need around $109,000 to have that same buying power.1

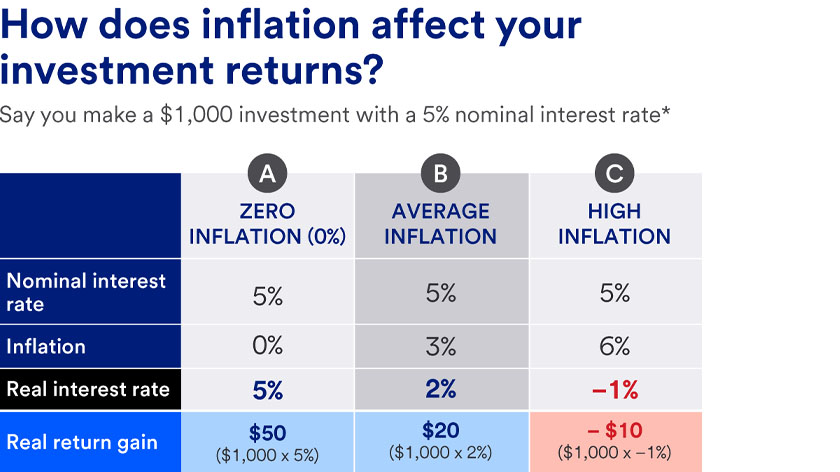

To understand how inflation can eat away at your investment returns, it’s important to differentiate between nominal and real interest rates.

For an investor to earn a real return, nominal interest rates must keep up with or outpace inflation. This means investments with lower interest rates are hit harder by the effects of inflation.

Cash and cash equivalents receive the biggest blow of all. When there’s no interest being generated to compete with the rate of inflation, it can quickly eat into the purchasing power of your cash.

Inflation can significantly reduce real returns on fixed income investments such as corporate or municipal bonds, treasuries and CDs.

Typically, investors buy fixed income securities because they want a stable income stream in the form of interest payments. However, since the income stream remains the same on most fixed income securities until maturity, the purchasing power of the interest payments declines as inflation rises. As a result, bond prices tend to fall when inflation is increasing.

Consider a one-year bond with a $1,000 face value.

Accelerating inflation is even more detrimental to longer-term bonds, given the cumulative impact of lower purchasing power for cash flows received far in the future.

In theory, a company’s revenues and earnings should increase at a comparable pace to inflation as companies raise prices to account for higher costs. This means the price of your stock in a company should rise along with the general prices of consumer and producer goods.

Similar to fixed income investments, however, high inflation can negatively affect nominal returns. For example, assume you have a return of 5% in your stock portfolio. If inflation is at 6%, the real return is negative (–1%).

Value stocks (companies that investors think are undervalued by the market) tend to perform better than growth stocks when inflation is high. Growth stocks (companies that investors think will deliver better-than-average returns) tend to perform better when inflation is low or normal.

Real assets, such as commodities and real estate, tend to have a positive relationship with inflation.

Commodities have historically been a reliable way to position for rising inflation. Inflation is measured by tracking the price of goods and services that often contain commodities directly, as well as products closely related to commodities. Energy-related commodities like oil have a particularly strong relationship with inflation, and industrial and precious metals also tend to rise when inflation is accelerating.

However, commodities have important drawbacks. They tend to be more volatile than other asset classes, do not produce any income, and have historically underperformed stocks and bonds over longer time periods.

When it comes to real estate, property owners often increase rent payments in line with the CPI, which can flow through to profits and investor distributions.

Inflation might be beyond your control, but that doesn’t mean you can’t take action to help preserve your investments and savings from its effects. A financial professional can help you determine what steps may be most appropriate for your situation.

Your investment strategy should reflect your goals, risk tolerance and time horizon. Learn how our approach to investment management can help you achieve your vision of success.

Related content