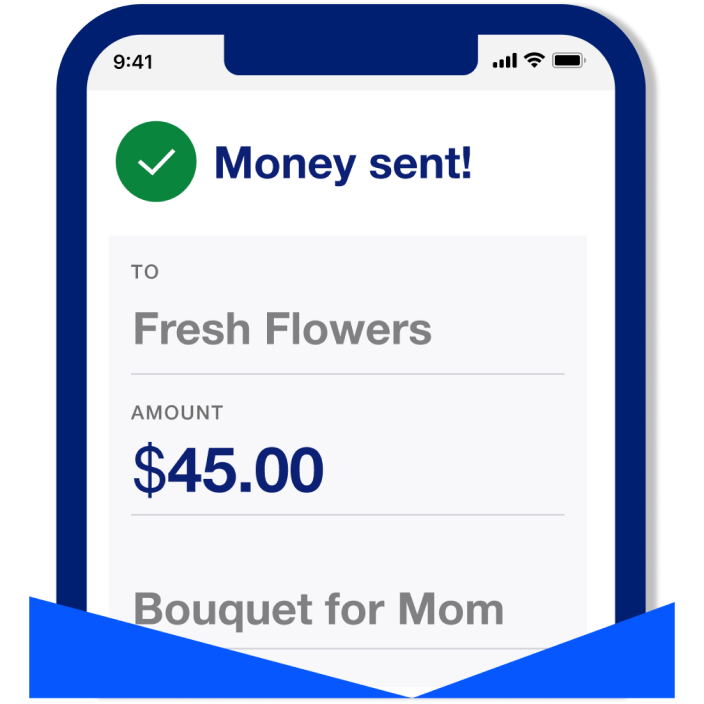

Zelle® is a fast, safe and easy way for small businesses to send money to, receive money from and request money from the customers and eligible vendors they trust. Transactions typically take minutes.1 If your customers use Zelle® within their financial institution’s banking app, they can send payments directly to your U.S. Bank bank account with just your email address, United States mobile number or QR code.

What is Zelle®?

Zelle® lets you send, receive and request money with your trusted customers and eligible vendors. If your customer uses Zelle® through their financial institution, they can send payments directly to your U.S. Bank account. Simply provide them with your email address or United States mobile number. The money will be withdrawn from their account and deposited into your account within minutes.1

Zelle® is available to consumers at over 2,000 financial institutions.

Enjoy the benefits of using Zelle®.

Easy

Skip the trip to the bank. Zelle® payments are deposited directly into your account.

Fast

Start to finish, a payment can typically be sent and received within minutes with enrolled users.1

Safe

There’s no need to provide your account information to receive payments1 with Zelle®.

Free

U.S. Bank offers Zelle® free to all small business checking and savings account clients.

Make payments easier with a QR code.

Give your customers the option to pay by scanning your QR code with the cameras on their smartphones.

Grow your financial knowledge.

Frequently asked questions

About Zelle®

Getting started

Receiving money

Sending money

Ready to get started?

Disclosures

-

Footnote 1Return to content, Footnote 1

-

Footnote 2Return to content, Footnote 2