U.S. Bank Smartly Savings

Open a Bank Smartly® Savings account to earn more money on your money.

Calculate your rate to see how it increases as your Combined Qualifying Balance grows. Your options update according to the information you provide. FYI: The displayed Annual Percentage Yield (APY) and interest rates are effective as of February 19, 2025 for ZIP code 55402 (Edit ZIP code)

Estimate how much you’ll maintain in your new savings account.

For higher relationship rates, you’ll need a U.S. Bank Smartly® Checking, Safe Debit or Bank Smartly™ Visa Signature® Card account. Do you have one?

Select your answers and calculate your rate to see how your savings rate grows.

Savings + Checking

When you open a Bank Smartly® Savings and Bank Smartly® Checking account together you:

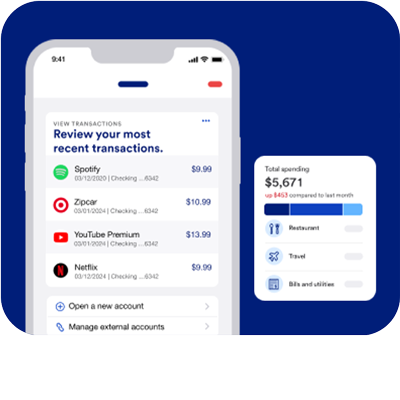

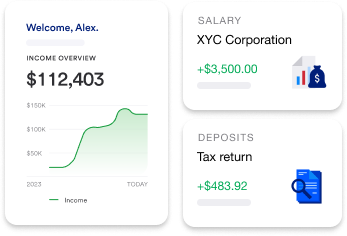

Bank Smartly® Savings gives you access to our easy-to-use digital budgeting tools to help you monitor all your accounts (even ones at other banks) and set clear financial goals.

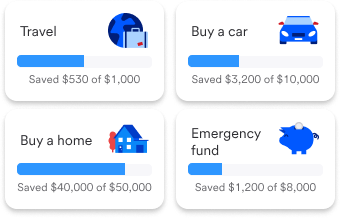

Set multiple savings or investment goals and use our convenient mobile app to monitor your spending and help you decide when it's time to move money around.

Use our digital tools to automate your savings to stash away a little (or a lot) with every paycheck. As your Combined Qualifying Balance grows, you may be able to earn higher rates.1 Set up recurring transfers when you switch your direct deposit in minutes.