Open a U.S. Bank Smartly® Checking account and you’re

automatically enrolled in Smart Rewards for free.

- Unlock higher rates on your Bank Smartly® Savings account8

- 0.50% discount on Home Equity Loan or Personal Loan when set up with autopay

- Take 0.25% of your new mortgage loan amount and deduct it from closing costs, up to a maximum of $1,0009

- 100 free trades per calendar year with a self-directed brokerage account, exclusively through our affiliate, U.S. Bancorp Investments10

- Access to debit card cash-back deals11

- Access to our U.S. Bank Vehicle Marketplace

“I get rewards just for checking? Tell me more.”

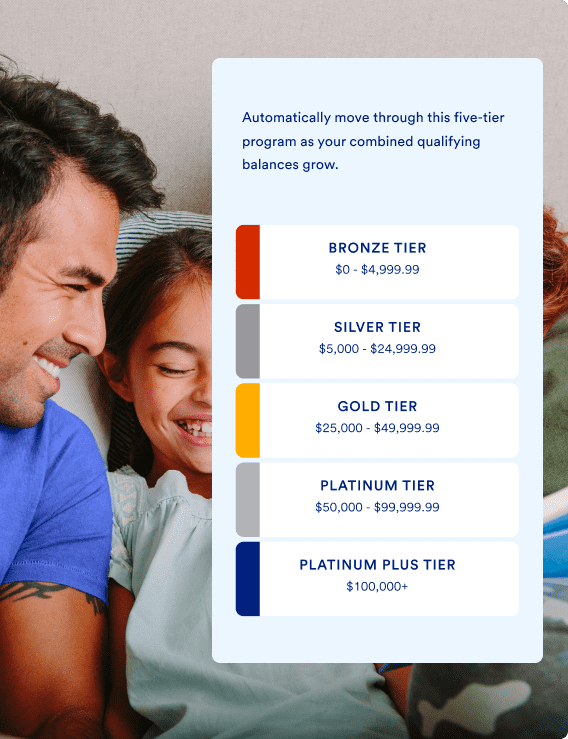

Smart Rewards® is our five-tiered bank rewards program that is complimentary with your Bank Smartly® Checking account. Enjoy progressively greater benefits (fee waivers!) based on your Combined Qualifying Balance. You’re automatically eligible for either the Bronze Tier, Silver Tier, Gold Tier, Platinum Tier or Platinum Plus Tier.

Estimate your balances to find your rewards

Do you belong to one of the following age groups? (optional)

Are you a member of any of the following customer groups? Select all that apply. (optional)

- Military (Veteran and active duty)

- Alliance (including State Farm®)

- Workplace banking participating employer

- Wealth

Are these your people?

If you are a member of one of the following customer groups, you’re automatically eligible for additional services and rewards tailored to meet your needs.

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts1

- 50% discount on personal check re-orders (U.S. Bank logo or personal) 12 and annual safe deposit box rental fees*

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts1

- ATM transaction fees waived on first four Non-U.S. Bank ATM transactions per statement period34

- Wire Transfer Fees waived for the first two incoming wires per U.S. Bank Smartly Checking statement period

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts1

- ATM transaction fees waived on first four Non-U.S. Bank ATM transactions per statement period34

- $5 Monthly Maintenance Fees are waived on all U.S. Bank Smartly Savings accounts*2

When an owner on an account is a member of the Military Customer Group, all other account owners receive Military Customer Group Benefits on that account.

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts1

- ATM transaction fees waived on first four Non-U.S. Bank ATM transactions per statement period34

- Non-U.S. Bank ATM Surcharge reimbursed for the first fee charged by ATM Owner (one per statement period, domestic only)3

- $10 Monthly Maintenance Fees are waived on all Elite Money Market accounts with a U.S. Bank Smartly® Checking account

- Exclusive cash-back deals across top merchants/categories with an eligible and open U.S. Bank Personal Credit Card13

- Unlimited fee waivers for: Cashier’s Check fees*, Personal Money Order fees*, Stop Payment fees

- 50% discount on personal check re-orders (U.S. Bank logo or personal)12

- IRA Annual Fee waiver14

Alliance (including State Farm®15,16) benefits are contingent on opening accounts through the Alliance partner channels. Products directly opened at U.S. Bank are not eligible for the Alliance Customer Group benefits.

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts126

- $10 Monthly Maintenance Fees are waived on all new U.S. Bank Elite Money Market accounts, for twelve months from the money market account open date17

- $10 Monthly Maintenance Fees are waived on all Elite Money Market accounts with a U.S. Bank Smartly® Checking account

- ATM transaction fees waived on first four Non-U.S. Bank ATM transactions per statement period34

- Exclusive cash-back deals across top merchants/categories with an eligible and open U.S. Bank Personal Credit Card13

- Premier service including:

– Access to a dedicated team of wealth professionals with planning, investment and banking expertise 18

– Dedicated concierge phone support

– Market and economic updates

– Exclusive event invitations

- Access to custom lending solutions, including Liquid Asset Secured lines of credit

- Higher money movement limits

- Immediate access to your funds 19

- Non-U.S. Bank ATM Surcharge reimbursed for the first four fees charged per statement period by an ATM Owner (domestic only)3

- Complimentary Wealth Management-branded personal checks 12

U.S. Bank Global Transition Solutions customer group currently has limited availability through qualifying referral partner programs (e.g. MUFG Bank).

- $12 Monthly Maintenance Fees are waived on all U.S. Bank Smartly® Checking accounts1

- $10 Monthly Maintenance Fees are waived on all Elite Money Market accounts with a U.S. Bank Smartly Checking account

- Exclusive cash-back deals across top merchants/categories with an eligible and open U.S. Bank Personal Credit Card13

- ATM transaction fees waived on first four Non-U.S. Bank ATM transactions per statement period34

- Wire Transfer Fees waived for the first two incoming wires per U.S. Bank Smartly Checking

*A Bank Smartly® Checking account and/or Smart Rewards® participation are not required to qualify for these benefits.

Combined Qualifying Balance

$0 - $4,999.99

- $12 Monthly Maintenance Fees are waived for the first two statement periods on all Bank Smartly® Checking accounts 1

- ATM transaction fees waived on first two Non-U.S. Bank ATM transactions per statement period 34

- $5 Monthly Maintenance Fees are waived on all U.S. Bank Smartly Savings accounts 2

- Smartly® Savings interest rate bump 8

- Overdraft Protection Transfer Fees waived 6

- 50% off initial box of personal checks 12

- 0.50% off Home Equity Loan or Personal Loan interest rates when set up with autopay

- Take 0.25% of your new first mortgage loan amount and deduct it from the closing costs, up to a maximum of $1,000 9

- 100 trades per calendar year with a self-directed brokerage account, exclusively through our affiliate, U.S. Bancorp Investments 10

- Complimentary access to Greenlight 7

- Access to our U.S. Bank Vehicle Marketplace

Frequently asked questions

General questions

Bank rewards differ from one financial institution to another. The U.S. Bank Smart Rewards® program has five tiers based on the Combined Qualifying Balances of all your eligible U.S. Bank accounts. As your balances grow, you automatically move up to the next tier. The higher the tier, the bigger the benefits. With the U.S. Bank Smart Rewards® program, several benefits are immediately available within five business days upon opening your Bank Smartly® Checking account:

As soon as your checking account is opened, you will be automatically enrolled in Smart Rewards®. Your Smart Rewards tier will be assigned within the first 5 business days to one of our five tiers based on the Combined Qualifying Balances of all your eligible U.S. Bank accounts.

Smart Rewards® does not have a fee and comes automatically with your Bank Smartly® Checking account.

Enrolling in Smart Rewards®

U.S. Bank Smart Rewards® are complimentary with your Bank Smartly® Checking account. No enrollment or sign up needed.

Yes, in order to take advantage of this rewards program, you’ll need to open a Bank Smartly® Checking account.

A rewards checking account is just like it sounds: it’s a checking account that awards extra benefits like loan discounts, fee waivers, and opportunities to earn cash back for making debit card purchases 11 using the account. Smart Rewards® does the same thing. You earn greater rewards as you move up through our five-tiered program.

U.S. Bank Smart Rewards® tiers

U.S. Bank Smart Rewards® consists of five tiers that offer progressively greater benefits based on your Combined Qualifying Balance across eligible accounts. The tiers are:

- Bronze Tier

- Silver Tier

- Gold Tier

- Platinum Tier

- Platinum Plus Tier

Each tier provides benefits and rewards to help you bank smarter now and in the future as your needs change. As your Combined Qualifying Balance grows, you automatically move up to the next tier of bank rewards. Please refer to the Consumer Pricing Information (PDF) disclosure for more details.

Combined Qualifying Balances (CQB) include consumer and trust accounts where the account is open, and you are an account owner.

- Consumer checking, money market, savings, Certificate of Deposits (CDs), and/or Individual Retirement Accounts (IRAs)

- Personal Trust accounts 21

- U.S. Bancorp Investments 22 accounts

- U.S. Bancorp Advisors 23 brokerage accounts

Note: Business and commercial products are never eligible.

Qualified Balance: Funds on deposit in an eligible product, where you have an ownership interest, are counted towards your CQB.

- Examples of eligible customer to account relationship types, include, but are not limited to: Individual owner, joint owner, primary non-signer.

Conversely, funds on deposit in an eligible product that do not grant ownership interest, are not counted towards your CQB.

The Combined Qualifying Balance requirements for each tier are as follows:

- Bronze tier: $0 - $4,999.99

- Silver tier: $5,000 - $24,999.99

- Gold tier: $25,000 - $49,999.99

- Platinum tier: $50,000 - $99,999.99

- Platinum Plus tier: $100,000+

If your daily Combined Qualifying Balance (CQB) qualifies you for a tier upgrade, you will be moved to the higher tier (within 5 business days). You will remain in that tier until you qualify for a higher tier based on your daily CQB, or the calculated monthly CQB qualifies you for a higher or lower tier. Tier downgrades will only occur at the end of every month. If the Bank Smartly Checking account is closed, the Smart Rewards benefits will cease.