Find a U.S. Bank ATM or branch near you.

Bank your way. You can make an appointment at a branch or bank online.

Enter your address, city, state or ZIP code.

Meet with a financial specialist.

Personal banker

Schedule time with a local banker to handle your personal banking needs.

Financial advisor

Schedule a call with a financial advisor from our affiliate, U.S. Bancorp Investments.

Business banker

Meet with a business banker to learn what options are available for your business.

Mortgage loan officer

Search for a mortgage loan officer close to home.

Bank when and where you want.

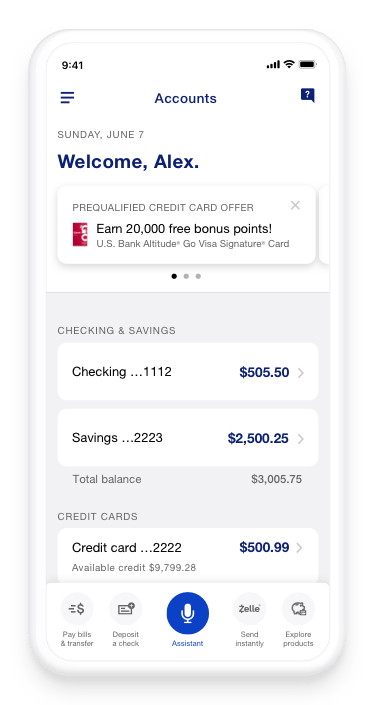

A mobile app that’s designed with you in mind.

Bank from anywhere you have a mobile connection with the U.S. Bank Mobile App.

A mobile app that’s designed with you in mind.

Bank from anywhere you have a mobile connection with the U.S. Bank Mobile App.

Transfer between your accounts

Deposit checks

Manage and pay bills

Send, receive and request money

Appointments

Make an appointmentConnect with a local banker and get the answers you need, when you need them.Online banking

See more detailsGet the information and features you need to manage your money on your computer.24-hour banking

Call nowContact us at 1-800-USBANKS (872-2657) and we’ll connect you with the right banker.

Get answers to your questions before you visit us.

Sometimes, using online banking or the U.S. Bank Mobile App can save you a trip to the branch or an appointment with a banker. Open an account, view current balances and transactions, transfer funds, access e-statements and tax documents, stay in control of your financial data and much more. Learn more about mobile and online banking.

Here’s what you can do at most U.S. Bank ATMs, besides withdraw cash:

- Check your bank account balances

- Deposit cash and checks

- Transfer money between accounts

- Make payments

- Reset your card PIN

Yes, you can order and buy foreign currency by visiting a branch. It’s a good idea to make an appointment to allow time for questions and processing. Schedule an appointment today to visit the branch at your convenience.

U.S. Bank virtual appointments use two-way video streaming technology to support your banking and financial needs. It allows you to have the same face-to-face interaction that you would have in your local branch but without leaving your home. Schedule a virtual appointment for help with a wide range of tasks, such as enrolling in online banking, setting up direct deposit, ordering new debit cards and more.

What you’ll need will depend on the reason for your visit. For most appointments, you’ll need proof of your identity, such as:

- Valid driver’s license

- State-issued photo ID

- Valid passport

Find more specifics and get answers to other common questions under support for appointment scheduling.

MoneyPass is a surcharge-free ATM network. This means you don’t have to pay an ATM fee for getting cash. Please note that deposits are not accepted at non-U.S. Bank ATMs. If a surcharge is charged to your account, please call 800-872-2657 to speak with a representative.

- Ada

- Akron

- Amelia

- Ashtabula

- Avon

- Avon Lake

- Batavia

- Beachwood

- Beavercreek

- Bedford

- Berea

- Botkins

- Brecksville

- Brilliant

- Cambridge

- Canal Winchester

- Centerville

- Chesapeake

- Cincinnati

- Circleville

- Cleveland

- Cleveland Heights

- Columbus

- Cuyahoga Falls

- Dayton

- Delphos

- Doylestown

- Dublin

- Eaton

- Elyria

- Fairborn

- Fairfield

- Fairlawn

- Fort Loramie

- Fremont

- Gahanna

- Gallipolis

- Galloway

- Geneva

- Grove City

- Hamilton

- Hilliard

- Hillsboro

- Hinckley

- Hopedale

- Huber Heights

- Hudson

- Independence

- Ironton

- Kettering

- Lebanon

- Lewis Center

- Logan

- Loveland

- Lucas

- Lucasville

- Marengo

- Mason

- Mayfield Heights

- Medina

- Mentor

- Miamisburg

- Miamitown

- Middlefield

- Middletown

- Milford

- Monroe

- Mt. Orab

- New Albany

- North Olmsted

- North Royalton

- Oak Harbor

- Oxford

- Parma

- Pickerington

- Portsmouth

- Reynoldsburg

- Rocky River

- Sandusky

- Sidney

- Solon

- Somerset

- Springboro

- Strongsville

- Tallmadge

- Tiffin

- Tipp City

- Toronto

- Troy

- Van Wert

- Versailles

- Warrensville Heights

- Washington Court House

- West Chester

- West Chester Township

- Westerville

- Westlake

- Wheelersburg

- Whitehall

- Willoughby

- Worthington

- Xenia

- Yellow Springs

Disclosures

Investment and insurance products and services including annuities are:

Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.U.S. Bank, U.S. Bancorp Investments, U.S. Bancorp Advisors and their representatives do not provide tax or legal advice. Each individual's tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bancorp Investments:

For U.S. Bancorp Advisors:

For U.S. Bank:

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc or U.S. Bancorp Advisors LLC.

U.S. Bank does not offer insurance products but may refer you to an affiliated or third party insurance provider.

Mortgage, home equity and credit products are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

The creditor and issuer of U.S. Bank credit cards is U.S. Bank National Association, pursuant to separate licenses from Visa U.S.A. Inc., MasterCard International Inc. and American Express. American Express is a federally registered service mark of American Express.

Equal Housing Lender