Welcome to the Tustin La Palma Branch.

Make your money work harder and smarter.

Earn interest, save money and securely invest with a U.S. Bank Smartly® Checking account. Member FDIC.

Which service can we help you with today?

Enter your address, city, state or ZIP code.

Let’s talk about your banking needs.

Meet with a local banker virtually, by phone or in person.

Your banker is here for you through our video streaming and co-browsing tools. Do everything from enrolling in online banking to opening a business account, and more.

Create a financial plan for your future.

Meet with a wealth management professional.

Ready to start your wealth journey? Wealth management professionals from U.S Bank and our affiliates U.S. Bancorp Investments and U.S. Bancorp Advisors can help assess where you are financially and create a personalized plan that fits your goals.

Get answers to your homebuying questions today.

Connect with a mortgage loan officer.

Understand and navigate the home buying process. Our mortgage loan officers tailor solutions to your unique needs.

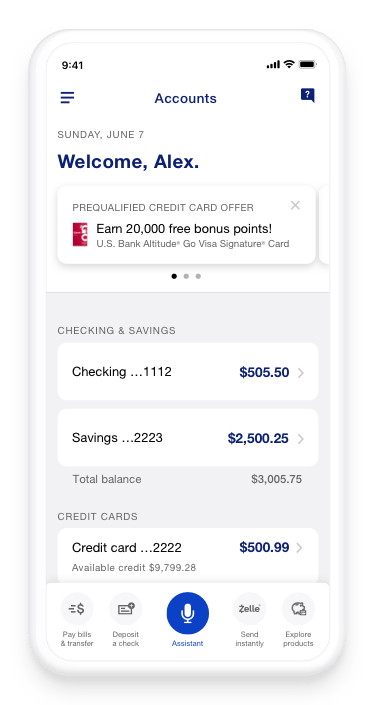

Bank when and where it’s convenient for you.

Bank when and where it’s convenient for you.

Open an account today. Manage and pay bills. It’s secure and easy. The U.S. Bank mobile app makes it simple to do all your banking, right here or wherever you go.

Read what's happening in our community.

FireAid benefit concert expected to exceed $100 million in donations

Navigating by the stars to achieve a brighter future for hometown scientists

U.S. Bank named an official banking partner of the LA Clippers

Banking that’s simple and convenient. Learn how.

You’ll need the following personal information and general requirements.

Forms of Identification

:

- If you’re a U.S. citizen, you’ll need your social security number – and a state-issued photo ID like a driver’s license, passport or military ID.

- If you’re not a U.S. citizen, you’ll need a W-8BEN with supporting documents – and a foreign passport, Visa or I-9.

Additional requirements

:

- A minimum opening deposit of $25 is needed to activate your account (once you’ve been approved). This can be paid with a prepaid, debit or credit card, a transfer from another U.S. Bank account or a transfer from another financial institution.

- You must be 14 years or older to open a checking account. Those under the age of 18 must have a co-applicant.

When you book an appointment, you’ll select the date and time, the purpose of your visit and if you’d like to meet at the branch, over the phone or virtually. Additional services include:

- Online banking

- Setting up direct deposit

- Ordering debit cards

- Notarizing documents (appointment required)

- Mobile app help

- Opening a checking or savings account

- Transferring money and more

What you’ll need will depend on the reason for your visit. For most appointments, you’ll need proof of your identity, such as:

- Valid driver’s license

- State-issued photo ID

- Valid passport

Find more specifics and get answers to other common questions under support for appointment scheduling.

Here’s what you can do at most U.S. Bank ATMs, besides withdraw cash:

- Check your bank account balances

- Deposit cash and checks

- Transfer money between accounts

- Make payments

- Reset your card PIN

Contact customer service by following these steps:

- Log into your U.S. Bank account.

- Select Customer Service at the top of the dashboard.

- Call us, choose from the list of applicable departments.

- Select email us on the right side of the page in More options.

- Navigate to Common answers for additional information.

Visit the U.S. Bank branch locator and enter your current city, state or ZIP code.

You may also select Locations in the upper right corner of the U.S. Bank home page to start your search.

Disclosures

Investment and insurance products and services including annuities are:

Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.U.S. Bank, U.S. Bancorp Investments, U.S. Bancorp Advisors and their representatives do not provide tax or legal advice. Each individual's tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bancorp Investments:

For U.S. Bancorp Advisors:

For U.S. Bank:

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc or U.S. Bancorp Advisors LLC.

U.S. Bank does not offer insurance products but may refer you to an affiliated or third party insurance provider.

Mortgage, home equity and credit products are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

The creditor and issuer of U.S. Bank credit cards is U.S. Bank National Association, pursuant to separate licenses from Visa U.S.A. Inc., MasterCard International Inc. and American Express. American Express is a federally registered service mark of American Express.

Equal Housing Lender